Pinduoduo Soars During a Rough Period for Chinese Stocks

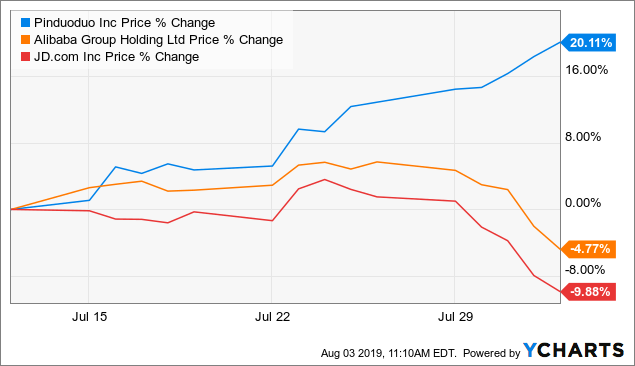

Pinduoduo, a group-buying focused e-commerce platform based in Shanghai, has been a lone bright spot in what has been a very difficult time for Chinese ADRs listed in the US. Amidst contentious trade relations between the US and China, many Chinese companies have suffered in the stock market. For example, two of Pinduoduo’s main rivals, Alibaba and JD.com saw their stock prices fall by 4.77% and 9.88%, respectively during the recent turbulence, while Pinduoduo’s stock rose 20.11% to $22.17.

Pinduoduo has taken the e-commerce industry in China by storm since bursting into the scene in 2015, with their innovative group-buying model that allows for more affordable prices available to bulk purchases. This model has been especially popular in third and fourth tier cities in China where consumers don’t boast the disposable income of people in Beijing or Shanghai.

SEE ALSO: Ep. 17: Pinduoduo: From Zero to $23B in Three Years

The company has reported impressive order volumes in the first half of 2019, as the total of orders shipped exceeded 7 billion or a daily average of more than 38 million units. The second half of the year is typically stronger for Pinduoduo, so the company can be encouraged by these results. The company also disclosed it has over 3.6 million merchants on its platform, and the number of active buyers per year has exceeded 443 million. The company has also boasted its exemplary customer service record, citing that it received 7,000 complaints in the first half of the year, which Pinduoduo claims is far below the retail industry average.

Pinduoduo’s gross merchandise value was conservatively estimated to be at least 46 billion yuan during the 18-day shopping event in June, representing an increase of more than 300% compared to the same period last year. This increase resulted from a 48% growth in MAUs, outpacing that of both e-commerce giants Alibaba and JD.com.

It seems that the company’s offer of goods at a lower price point, combined with a lower cost average to advertisers has allowed Pinduoduo to weather the capital market storm and continue to grow its market capitalization. Pinduoduo enjoyed positive growth despite the uncertainty in the US-China relations that has led to underwhelming performance for many Chinese companies listed in the US.