Decoding ByteDance’s Strategy to tap India’s Music Streaming Market

Late last year Chinese tech behemoth ByteDance released a beta version of its upcoming music app, Resso, with the goal of tapping the music streaming market in India and Indonesia. Following FT, many in the Indian media picked up the development – but none so far ventured to understand why ByteDance decided to enter the music streaming industry in India which is already so competitive, and if there was something that made Resso unique.

SEE ALSO: ByteDance’s New Mobile Game Ranks Second Among iOS Free Games on First Day

If you look closely, which we do in the analysis below, it is an absolutely fascinating strategy both in terms of product as well as in terms of market placement.

We’ll discuss some some unique product features of the app in detail. But before we dive into that, let’s try to understand how the music streaming industry works and what the market is like.

There are two big challenges.

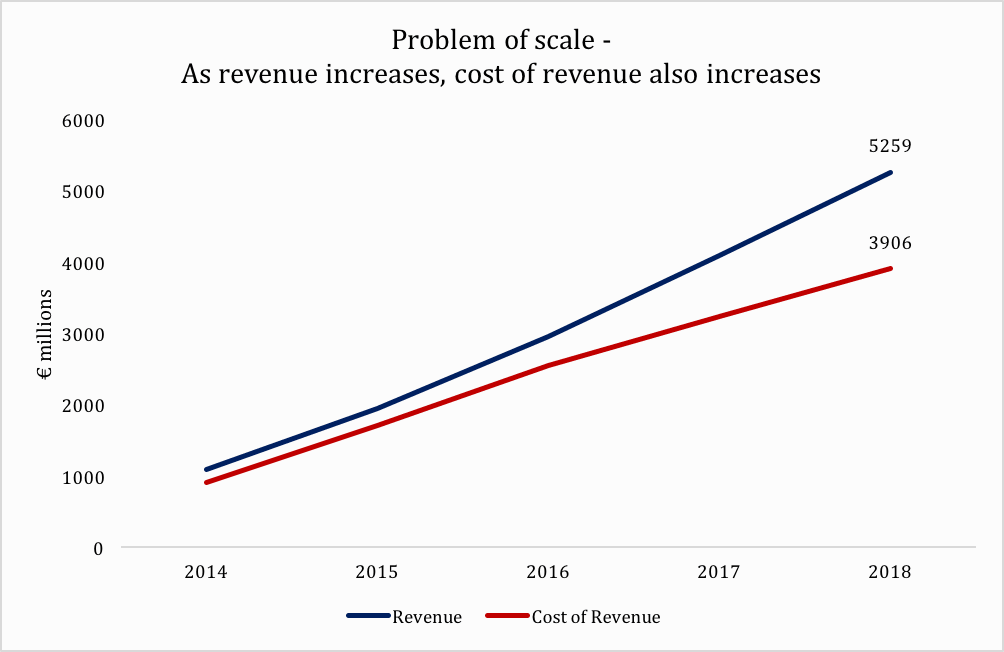

First, the unit economics of the music streaming industry is messed up. Let’s take Spotify’s example. Spotify partners with major record labels to put their music on its app. In return it pays a royalty to the music labels. For each dollar that the company earns, it has to pay a fraction of that dollar to the music industry. This means that as the company’s revenue increases, it’s operating costs also keep increasing. This is problematic for scalability.

Given that Spotify is not a platform, there are no network effects associated with it and in order to acquire new users, it needs to keep spending on sales and marketing. Therefore, unless they reduce their cost of revenue by renegotiating their royalty deals with music labels, the company’s overall operating margins do not improve.

Now, one way to solve this problem would be to produce your own content – which streaming companies like Netflix and Amazon Prime do. Netflix is likely to spend nearly $20 billion on original content this year and Amazon is supposed to have spent upwards of $6 billion on content in 2019.

Spotify has caught hold of that and is investing a lot in producing its own content, especially podcasts. Take a look at the companies Spotify has been acquiring over the years:

Also, take a look at the type of jobs it is hiring for in India:

Clearly, the company is investing a lot in podcasts and relying on them to improve its margins.

It is important to note here, that most of the revenue Spotify earns is from its subscribers. Here’s a screenshot from its 2019 Q3 Financial Statement which shows that globally its premium subscribers are growing almost as fast as its ad supported MAUs.

However, I would be surprised if it is the same for India, where the market is extremely price sensitive and Spotify has been offering extremely competitive prices. This makes Resso’s strategy of focusing on the Indian and Indonesian markets, extremely interesting.

Take a look at the Average Annual Revenue per Paying User (ARPU) in US$ for music streaming apps:

Note that the ARPU in US is ~$30. Now, if unlike Spotify which works globally, Resso decide to focus on a competitive and price sensitive market like India with low ARPUs, its business model is likely to be quite different and rely heavily on advertising revenue.

Add to that, the Indian music industry is not exactly a blue ocean. There are several competing players.

These two points together, make for the second big challenge for Resso.

A summary of publicly available information for existing players is as follows:

So, the question arises – how can Resso build a business model in a country like India where:

- ARPUs are low

- Competition is high

- Advertising CPM values are low

One way to grow in such a market is to differentiate your product. How do you do that for a music app?

Stay with me here, now that we’ve painted a picture of the market, we’ll go into the features in a minute.

But before we dissect Resso’s app, let’s take a look at the Innovation Ambition Matrix that Bansi Nagji and Geoff Tuff, then partners at Monitor Group, wrote in their 2012 HBR piece that has since become a cool consulting framework to brainstorm product ideas as a team.

One way to think of new product ideas is to think about what is the core product feature that exists. Usually in a competitive non-monopolistic market, there are players with existing products (interventions) that serve existing market needs. From there, one could think “what are the adjacent needs around that core product that could be served with a few incremental product features?”. In the case of Resso, the core product is music. However, there are already many existing interventions in the market that satisfy such a need.

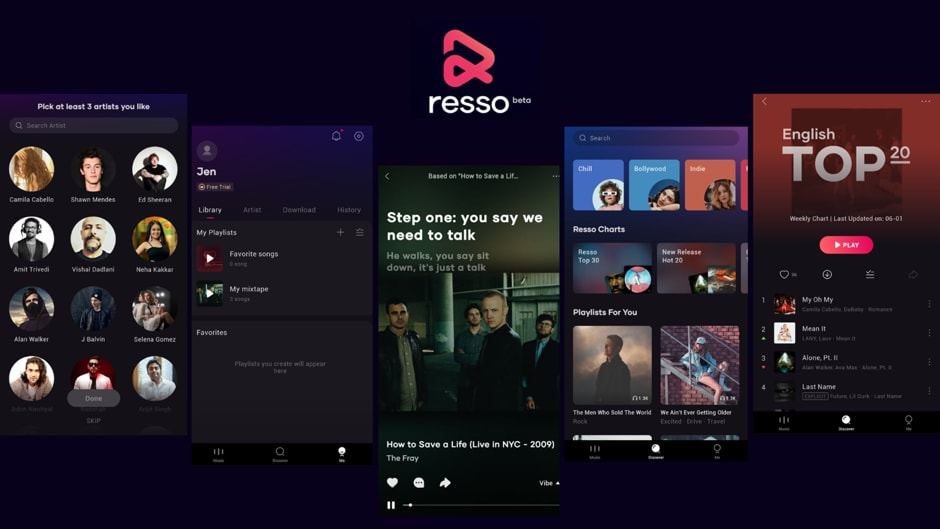

So, for Resso to differentiate its product, it needs to add some “Adjacent Features”. Resso does that by introducing what it calls “Vibes”. These are short GIF like videos that play in the background on a full screen as the lyrics of the songs get displayed in front. Users can create, comment and share these Vibes, edit the lyrics to the songs, report any spam/advertising or just leave a heart if they like the song. Basically, what Youtube already does, but in a very TikTok like interface.

Most of the other features are what would be in any other music app, except one additional item. You can create images of the lyrics with fancy backgrounds and share them on other social media platforms.

See what they did?

Go back to the biggest problem Spotify has had with scaling – lack of network effects to grow users. What Resso tries to do here, is to add an element of social activity. By engaging users to create their own content and share it in different ways creates a layer of User Generated Content (UGC) over its core content aggregation layer.

Other music apps also show lyrics, but they don’t allow users to create content on their apps. While Spotify is looking to hire professionals to create content for its app, Bytedance is relying on users to create content on it!

In a way, it adds another layer of value generation to its product and “platformifys” it to a certain extent.

Given such a product, there is a possible point that could arise in the future where the right product features could enable social sharing, solving the problem of new user growth that music streaming platforms like Spotify have. The Indian users already do that – from sharing Good Morning images and funny videos to Meesho’s catalog. Social sharing on Whatsapp and other such platforms in a unique behaviour that the next billion users enjoy a lot.

Having a large enough number of such engaged users could also mean that Bytedance relies on advertising to monetize Resso. It has already created a large enough advertising sales team in India, so the marginal effort in building that organizational capability at scale should not be a big problem. Note that given India and Indonesia’s lower spending power compared to other markets like the US, it makes sense to create a sizeable portion of revenue channel to come from advertising.

To add to that, if I were to go one step further and think about potential breakthrough features that could be added to this layer – to enter the transformational category of the matrix described above, I can think of several pieces that could be built on top of this layer which don’t yet exist in the market. For example: with a large enough data pool of lyrics, creating a virtual Karaoke network for users or allowing podcasters to post their transcripts for people who also want to read as they listen (there are many podcast listeners that pay to read podcast transcripts).

Still, the biggest challenge that the company would face would be from existing players – especially those that offer bundled services. At the time of writing this analysis, I have 3 music apps on my phone. I get Amazon Prime music app bundled with my Prime account- which I use for watching TV shows, shopping online and downloading songs. I get a free Wynk app with my Airtel account and I use the free version of Spotify because it has the best playlists and podcasts on it (I end up using Spotify the most but paying it nothing). Last week after ET announced its bundled service (which includes Gaana), I also considered downloading Gaana, which has the largest number of MAUs in India. I’m yet to make up my mind if I need a fourth music app if I get additional ET services.

Regardless, the Indian consumer is sure to benefit from ByteDance’s entry. Detractors of the company made the mistake of denouncing Tiktok as stupid/ not entertaining/ “who would watch such videos?” once. I don’t think they should do the same with Resso.

We would love to hear what you think in the comments below. If you liked this article, please leave us a heart above?

See what we did? Took a page out of Resso’s playbook. I hope it works 😉

Thanks,

Ravish B

The article was originally published on Ravish Bhatia’s blog turnaround.substack.com